Have you ever noticed your profit margins shrinking, even when your sales are steady? It might be more than just rising costs — the real issue could be revenue leakage.

Revenue leakage happens when earned income slips through gaps in your system. This could be due to billing errors, manual processes, or missed renewals that go unnoticed.

Each mistake may seem small, but over time, it leads to significant lost revenue and disrupts your cash flow. Most companies don’t even detect the leaks until they’ve already lost thousands of dollars.

In this post, you’ll learn everything you need to know about revenue leakage and how to fix the workflow issues that cause it.

Revenue leakage is the loss of income your business has earned but never actually receives. It’s not caused by poor sales or market downturns, but by avoidable errors and inefficiencies.

The challenge is that these revenue leakages often happen quietly during routine operations. For example, issues such as a missed invoice, an expired contract, or an unbilled service can quickly add up.

Even a 1% leak can eat into your profit margins and disrupt your cash flow over time. That may not sound like much at first, but for a company earning $10 million, that’s up to $100,000 in lost revenue.

Think of it like a leaking bucket. You keep generating new sales, but if those holes aren’t sealed, your revenue will still drain away.

Now that you know what revenue leakage is, let’s look at the causes and examples of revenue leakage. Every one of these small cracks can result in revenue leakage if ignored.

Below are the common causes of revenue leakage and how they show up in real-life scenarios.

Relying on spreadsheets and manual entry leaves your operations vulnerable to errors, inefficiencies, and inconsistencies. Manual processes slow down workflows, increase the risk of mistakes, and make it difficult to enhance customer experience and ensure accuracy across billing cycles.

Manual data entry is prone to errors that can result in revenue leakage. A single missing zero or incorrect quantity can skew your revenue figures. These minor discrepancies can accumulate to significant losses.

Beyond the financial impact, manual processes also hurt customer experience. Delayed invoices, incorrect billing, or refund errors can frustrate customers and weaken their trust in your brand.

Also Read:

Duplicate invoices, missed charges, or inaccurate billing can quietly drain your revenue. One small typographical error can cost hundreds or even thousands of dollars over time.

Imagine a SaaS company with hundreds of subscriptions. While some accounts renew automatically, a missed billing schedule update can cause revenue leakages. These overlooked renewals often go unbilled for months, quietly costing the company thousands in lost revenue before anyone even notices.

Additionally, unbilled renewals or failed payments can lead to involuntary churn, where customers lose access without meaning to cancel.

Unauthorized discounts, outdated pricing models, or mismatched rates can damage your profit margins. Even minor pricing errors can snowball into serious financial gaps.

Let’s say your sales team runs a limited-time promo for 15% off. But the code never expires, and customers keep using it for months. That small mistake can reduce margins and affect your profit forecasts.

Although misused discounts might boost short-term sales, they can also create confusion that affects customer engagement.

Service-based businesses often lose track of billable hours when contracts or timesheets aren’t updated properly, which can lead to revenue leakage.

For example, a manufacturing company signs multi-year supply contracts but lacks a centralized tracking system. When some contracts expire unnoticed, the company keeps supplying products without updating billing records.

Over time, this oversight causes significant revenue leakage. Poorly tracked or outdated customer contracts can cause missed renewals and unbilled services.

Poorly managed contracts don’t just impact revenue, they also undermine your customer satisfaction goals. Today’s customers expect accuracy, transparency, and consistency in both billing and customer service delivery.

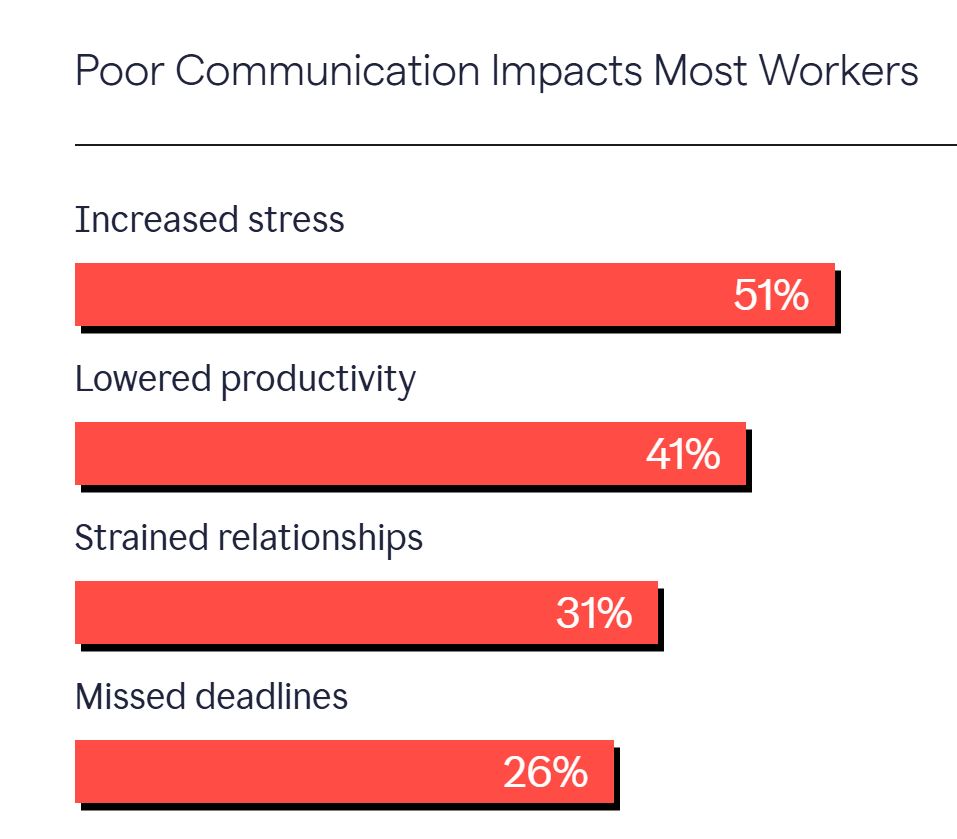

Poor communication across teams is a major cause of revenue leakage. A 2024 report showed that poor communication increased stress among workers, leading to lower productivity and missed deadlines. These gaps silently erode revenue over time.

Image via Grammarly

Missteps such as unrecorded discounts, mismatched invoices, and delayed collections frequently stem from cross-departmental misalignment.

Without effective communication and interdepartmental collaboration, even the most advanced automation or reporting tools cannot entirely prevent these revenue leakages.

You need to make your business more productive as these inefficiencies reduce visibility and make it harder to find revenue leakage.

One of the biggest challenges SaaS businesses face is weak follow-up on payments, which often leads to overdue invoices piling up.

When invoices aren’t consistently tracked and reminders aren’t sent promptly, customers may simply forget to pay or delay payments. These can cause unseen revenue leakage that quietly impacts your cash flow.

Another issue that often goes unnoticed is usage tracking errors. If a customer exceeds their subscription limits but isn’t billed for the extra usage, your business ends up absorbing those costs. Over time, these contribute to significant revenue leakage.

Also Read:

So, how can you tell exactly how much money is slipping away from your business?

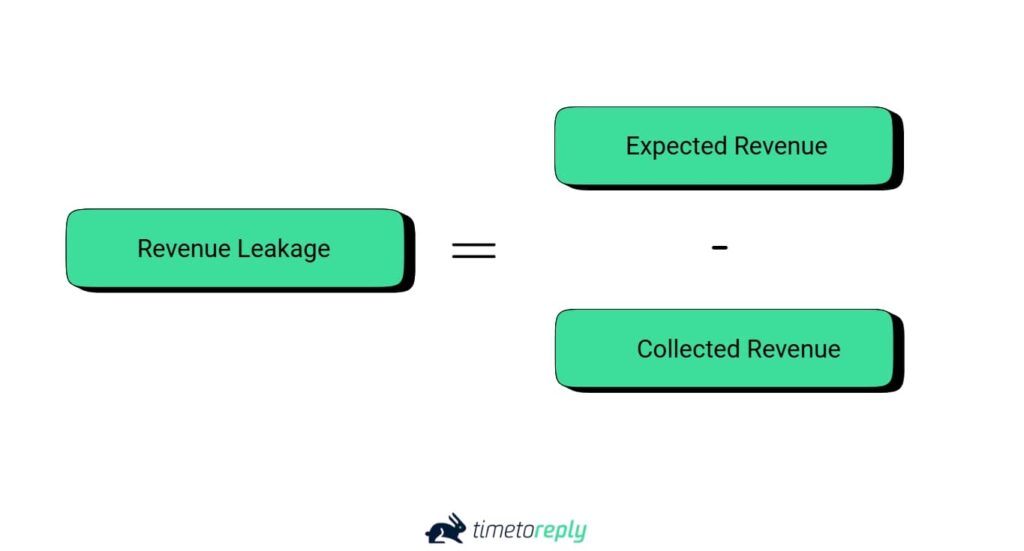

Start with a simple formula:

Revenue Leakage = Expected Revenue – Collected Revenue

For example, imagine your SaaS company projected $100,000 in monthly subscriptions but collected only $95,000. That $5,000 gap represents your revenue leakage, which is the income that was earned but never realized.

Once you can quantify it, you can pinpoint these revenue leakages and fix them before they drain your profits. That’s why calculating revenue leakage regularly is just as important as tracking your expenses.

How do you actually identify and track revenue leakage before it drains your profits?

Here are simple ways to start:

You can’t fix what you don’t measure. Start tracking early, and you’ll spot leaks before they turn into lost profits.

Also Read:

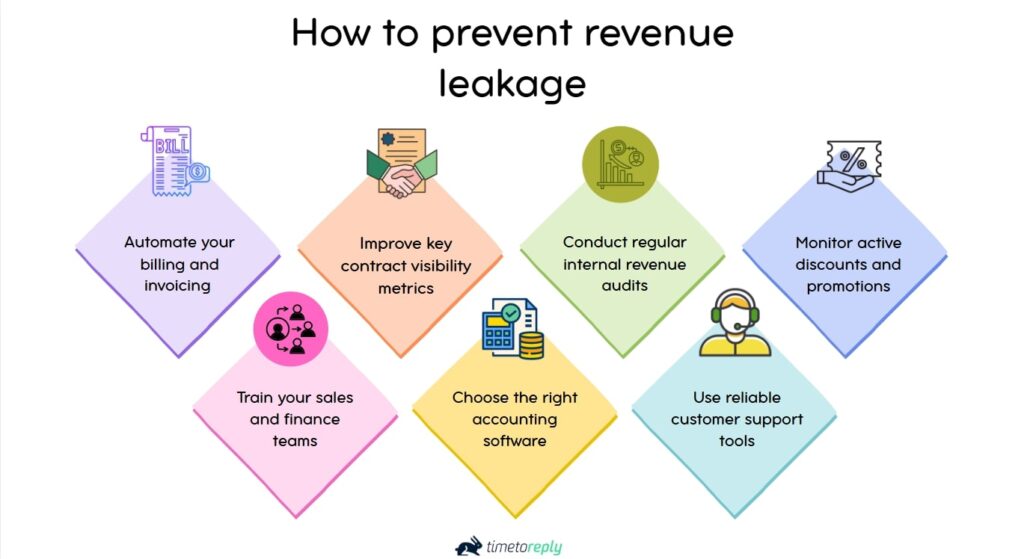

Now that you understand how revenue leakage occurs, the next step is to prevent it. Here are the most effective ways to prevent revenue loss:

Manual billing is one of the biggest causes of missed payments and underbilling. When you automate billing, you eliminate repetitive errors and improve on-time collections.

Recent research on SMEs shows automation boosts productivity by up to 30% and reduces manual errors by 25%, improving efficiency. Integrate your billing system with project management and inventory levels to ensure every resource is accounted for.

Lack of visibility into contracts often results in missed renewals, unbilled changes, and unnoticed revenue leakage. Implement a centralized contract repository with automated alerts for key dates, terms, and pricing updates to stay on top of every obligation.

This ensures all billable items are captured on time and gives your team the transparency needed to manage contracts and revenue more effectively.

Schedule quarterly or biannual audits to identify and address unnoticed revenue gaps.

During audits, compare booked revenue with actual cash received to identify discrepancies early.

You can also integrate your CRM and accounting systems to make data verification seamless and efficient.

Discount leakage is often overlooked, but it can have a significant impact on your revenue over time. Closely monitor all discount activity, including coupon codes, promotional offers, and pricing exceptions, to ensure they are properly authorized and aligned with your pricing strategy.

Unchecked discounts impact margins and can create inconsistencies that lead to long-term revenue leakage.

Finally, the tools you use make a significant difference. Select accounting software that supports automation, integrates seamlessly with other business tools, customer success software, and includes built-in compliance features.

This ensures your entire financial process, from invoicing to reporting, runs efficiently and transparently. The right platform reduces manual workload, provides integrations to streamline your workflow, and minimizes the risk of revenue leakage caused by data silos or human error.

You can use customer service software to automate dispute resolution, reduce friction, and improve payment speed. Pair your accounting platform with customer service tools for improved billing-related communication.

In addition, customer support tools can play a crucial role in identifying revenue leakage early.

Let’s be honest, technology alone can’t fix everything. Preventing revenue leaks takes more than just software. It requires skilled teams who know what to look for and a strong structure that supports efficient, accurate workflows.

Your team is your first line of defense against revenue leakage. Invest in training programs that help them understand communication, billing policies, contract terms, and build essential customer service skills. Continuous training will help to improve customer service across every interaction.

Also Read:

If revenue leakage has already started, don’t panic. You can still rectify the situation and recover lost income with the right actions.

Here’s how to plug the leaks and get your finances back on track:

Start by tracing where money is slipping away. Compare your booked revenue with actual collections, and check for mismatches in:

Reconciliation helps identify and correct unnoticed errors in your accounting system. Match your invoices, payments, and deposits line by line to ensure all recorded revenue aligns with actual cash flow.

Performing this process monthly helps prevent discrepancies from snowballing and protects you from major year-end surprises.

Sometimes, revenue leakage occurs due to outdated or unclear pricing models. Review every active contract to ensure your terms reflect current rates, billing, and deliverables.

If you manage subscriptions, ensure your subscription management software automatically updates pricing for renewals to prevent potential revenue leakage.

Use the best recurring billing software and accounting tools that automatically sync payments, subscriptions, and invoices. These tools reduce manual errors and help prevent revenue leakage by ensuring consistent, accurate income flow monitoring.

Integrate your CRM and accounting systems for effective customer engagement and to maintain complete transparency across your entire revenue cycle.

Underbilled accounts are a common source of revenue leakage, but they can often be recovered if caught early. To plug these leaks, set up a structured follow-up process that includes automated payment reminders, follow-up emails, and escalation steps for overdue accounts.

Additionally, consider offering early-payment discounts or flexible payment plans for long-term clients to improve recovery rates and reduce ongoing revenue leakage.

Once you’ve addressed existing leaks, the work isn’t over. Develop a dedicated revenue leakage dashboard that tracks critical metrics such as invoice accuracy, days sales outstanding (DSO), and churn rate.

Consistently monitoring revenue leakage enables you to quickly identify and plug new gaps before they impact your bottom line.

Also Read:

Revenue leakage isn’t just a finance issue, it quietly undermines customer success, erodes trust, damages brand reputation, and hinders long-term business growth.

Here’s how revenue leakage impacts your business:

Fixing these issues involves creating a sustainable system that protects your earned revenue, improves customer experience, and drives long-term growth.

Also Read:

1. What causes revenue leakage in businesses?

Revenue leakage occurs when earned income is not collected due to factors like manual processes, inaccurate billing, errors, or poor system integration.

2. How can I identify revenue leakage?

You can identify revenue leakage by doing the following:

3. Why is it important to fix revenue leakage early?

Small leaks might seem insignificant at first, but over time, they can multiply and cause substantial damage to your bottom line.

Addressing revenue leakage early ensures that every dollar your business earns is captured, helping you maintain healthy cash flow and protect profit margins.

4. What are the best ways to prevent revenue leakage?

You can prevent revenue leakage by doing the following:

5. Which industries experience the most revenue leakage?

Revenue leaks affect industries that rely on complex billing or recurring payments, such as:

Anywhere pricing or customer contracts are complex, the risk of revenue leakage is high.

6. How often should I audit my billing and revenue systems?

You should audit your billing systems and revenue collection systems at least once every quarter.

Regular reviews help uncover administrative errors, unauthorized discounts, or outdated customer information that could cause leaks. The earlier you spot these issues, the easier it is to fix workflows and maintain consistent profit margins.

7. What’s the difference between revenue leakage and revenue loss?

Revenue leakage occurs when your business has earned income that doesn’t make it into your accounts due to internal errors, inefficiencies, or oversights.

In contrast, revenue loss happens when potential income is never realized. For example, when you lose customers or miss out on sales opportunities.

Simply put, revenue leakage is often preventable. You can improve your internal processes and controls. Revenue loss, on the other hand, usually calls for more substantial sales efforts and customer retention strategies.

8. Can automation tools eliminate revenue leakage?

While automation tools can help reduce revenue leakage, they don’t eliminate it. Automated billing and revenue recognition systems help minimize human error, missed invoices, and data mismatches.

However, businesses still need regular monitoring, system audits, and data validation to catch exceptions or integration issues that cause revenue leakages.

Also Read:

When revenue leaks go undetected, they quietly affect your profit margin and reduce long-term growth. The good news is that with the right precautions, you can address revenue leakage before it becomes a problem.

Don’t wait until the numbers don’t add up. Strengthen your revenue assurance practices, train your teams, and invest in tools like timetoreply to improve billing accuracy and data integrity.

timetoreply gives your team real-time visibility into customer communication, response times, and follow-ups. You’ve worked hard to earn that revenue; now make sure you keep it.

Get started with timetoreply to spot slow replies, prevent revenue leakage, and improve customer responsiveness.

Get live inbox alerts and reply quickly to customer emails with timetoreply