Slow response times frustrate customers—and cost you their loyalty. The longer it takes you to reply, the more you lose their trust. But most businesses don’t know why their response times are slow or where the delays happen.

That’s because they’re not using data to improve email response times.

Without visibility into performance or workflow gaps, even skilled teams fall short.

The result? Missed SLAs, overwhelmed agents, and unhappy customers.

The solution is clear: use data to improve email response times. From identifying bottlenecks to tracking team output, these valuable insights give you the clarity needed to move faster, respond smarter, and retain more customers.

Email response time is the measure of time between receiving a customer email and providing a response.

While various benchmarks exist for the ideal email response time in each industry, one thing is universal. The quicker you provide an adequate response to a customer email, the better for your business – and for your bottom line.

Using data to improve email response times ensures that businesses remain efficient and meet customer expectations without delays.

Industry benchmarks for email response time vary across different industries, but in general, the expectation is for businesses to respond within 24 hours.

It’s different for chat. A study shows that the average response time for customer service chat is 2 minutes 40 seconds. However, customers expect replies within 45 seconds to feel satisfied.

Image via Superoffice

For example, customer-facing teams in ecommerce or SaaS businesses may be pressured to respond even faster to maintain a competitive edge and boost customer loyalty.

Delayed responses can lead to negative impressions: Seven in ten customers in one study said they believe companies don’t care if their customers receive delayed responses.

The result?

Reduced customer loyalty, increased churn, and damage to the company’s brand and reputation. By using data to improve email response times, companies can reduce these negative effects and ensure customer satisfaction is consistently high.

Failure to meet customer expectations regarding response times can significantly harm your business.

According to Ringover, data shows that 36.8% of people said that slow responses from customer support resulted in a poor experience. This can significantly impact customer loyalty.

This emphasizes why businesses should leverage data to improve email response times.

Also Read:

Customer-facing teams often struggle with bottlenecks that disrupt their ability to respond quickly. Identifying and resolving these barriers is essential, and using data to improve email response times is the key to doing it effectively.

Here are the most common bottlenecks and how they impact performance:

Many teams rely on shared inboxes to manage incoming queries. But when no one is directly assigned to specific messages, emails often go unanswered.

Team members may assume someone else is handling the query, resulting in long delays. Using data to improve email response times can reveal how long emails sit in shared inboxes and who responds the slowest, helping assign clear ownership.

Without insight into how individuals or teams are performing, it’s nearly impossible to spot delays. Data to improve email response times gives managers a live view of reply rates, response gaps, and unresolved tickets. This allows for better oversight and faster intervention.

Many companies still rely on outdated systems that don’t alert you when SLAs are about to be breached. As a result, teams miss critical deadlines, hurting customer satisfaction and retention.

Email tracking tools that use data to improve email response times can monitor SLA compliance in real-time, making it easier to act before a breach occurs.

Inbox clutter from CCs, internal threads, or non-urgent customer emails can push urgent requests further down the queue. Leveraging data to improve email response times helps teams categorize and prioritize emails, ensuring the most critical issues are resolved first.

If teams manually read and assign every email, they waste time that could instead be spent on resolution. Automation powered by data to improve email response times can tag and route emails based on urgency, subject, or sender—freeing agents from repetitive tasks.

Some teams lack documented processes for how to handle incoming emails—who should respond, when to escalate, or how to categorize queries.

By analyzing workflow patterns using data to improve email response times, companies can standardize responses and reduce confusion.

The best customer-facing teams use data to improve email response times and consistently meet evolving customer expectations.

Without data-backed insights, businesses may operate blindly, unaware of what’s truly causing delays or inefficiencies in their customer communication workflows.

Leveraging data to improve email response times not only increases team productivity. It also directly enhances the customer experience by ensuring faster, more accurate responses.

Using accurate data about a range of email response analytics also enables customer-facing teams to identify trends and patterns in customer interactions. This improves their ability to solve problems, reduce bottlenecks, and deliver more personalized customer experiences.

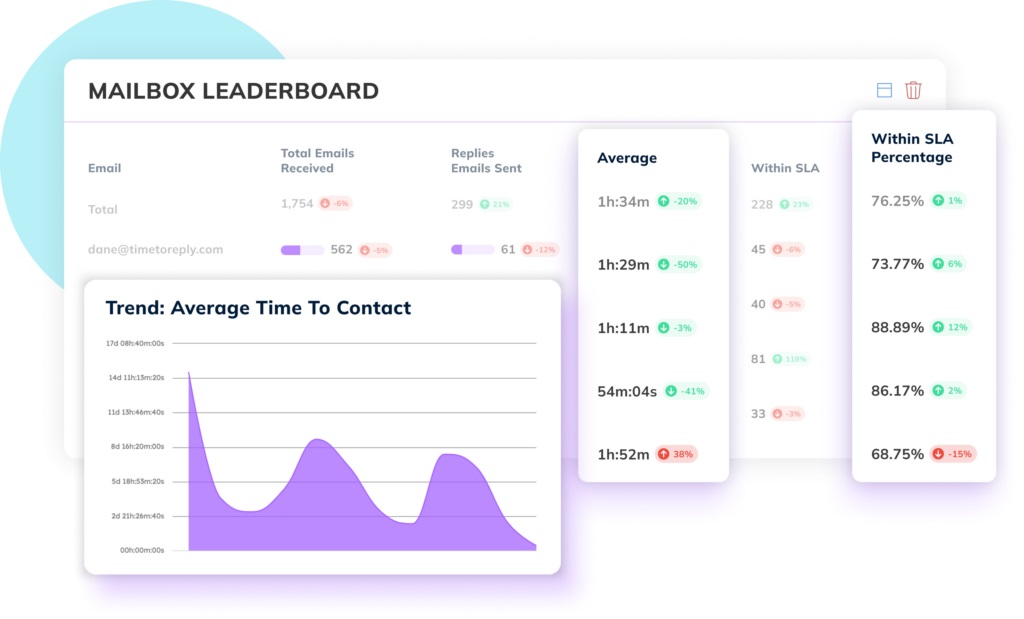

Image via timetoreply

Among the most valuable metrics to track when using data to improve email response times are:

It’s near-impossible to manually keep track of reply times and ticket resolution times, especially in busy team environments with high email volumes.

The most successful customer-facing teams use an email analytics optimization platform to track a range of email metrics and produce data-rich reports about the team’s email performance.

Here are some of the benefits:

By regularly using both types of analytics and applying this data to improve email response times, businesses gain a significant edge. This advantage enhances both customer satisfaction and operational efficiency.

Also Read:

To successfully use data to improve email response times, you must go beyond tracking a few basic numbers—it’s about understanding the full picture.

By analyzing the right metrics in context, customer-facing teams can set realistic benchmarks. This helps them spot underperformance early and enhance the overall customer experience.

While earlier sections covered foundational metrics like average time to first reply and ticket resolution time, this section explores how to go deeper with your email analytics strategy.

So, let’s dive in.

Your first reply time is the average time it takes for your team to send the first response to a customer’s email. Meanwhile, your all replies time is the average time between responses within a thread.

How is it helpful?

Use this data to improve email response times by identifying threads where customers are waiting too long between replies, even after the initial message. A fast first reply is important, but sustaining that responsiveness throughout the conversation is what builds trust.

Analyzing response patterns by hour reveals when your team is fastest and when they’re lagging.

Data to improve email response times in this area can help teams schedule more staff during peak hours or assign queries differently to maintain SLA compliance.

For example, if response rates dip after 3 pm, that’s a red flag for resource reallocation.

This metric breaks down how each team member or sub-team contributes to the overall response workload. This doesn’t just show volume; it also depicts how efficiently and quickly agents handle emails.

If an agent has a significantly higher volume but consistently delayed replies, data to improve email response times will show this as a potential bottleneck.

Use this as an opportunity to coach underperforming agents, balance workloads, or reward top performers.

Once you’ve gathered these insights, the next step is turning them into performance benchmarks. Use past data to improve email response times. They act as your baseline. Then, you can adjust goals based on current team capabilities and industry standards.

Setting individual and team-level targets helps align the team around measurable, time-bound objectives. Also, benchmarks allow you to track incremental improvements and course-correct before issues escalate.

By regularly reviewing these essential metrics and combining them with real-time insights, your team will gain the clarity they need to improve service quality and enhance customer satisfaction—one email at a time.

Tracking email response times and other relevant performance metrics is essential for maintaining strong communication and optimizing operational efficiency. Fortunately, several email response tools help teams track reply times, response rates, and resolution metrics to boost performance and customer satisfaction.

Image via timetoreply

Timetoreply is a powerful email analytics platform designed to help businesses monitor individual and team email response times and performance in real time.

It tracks essential metrics, such as average response times, first reply time, reply rates, and SLA adherence.

By providing actionable insights, timetoreply allows managers to identify bottlenecks, uncover trends, and implement changes to improve team efficiency.

If your goal is to meet strict SLA targets, timetoreply makes it easier to use data to improve email response times across departments.

Image via Zendesk

Zendesk is a well-known customer service platform that offers powerful email ticketing features. It allows businesses to use data to improve email response times by organizing, assigning, and responding to incoming emails efficiently.

It includes automated workflows, SLA timers, and robust reporting tools. These features make it easy to track response times and ensure nothing slips through the cracks.

Zendesk’s analytics dashboards help teams measure email performance across agents, teams, and periods. It also supports multichannel customer engagement for a unified support experience.

Image via Front

Front combines the familiarity of email with the efficiency of a help desk. It helps customer-facing teams efficiently use data to improve email response times. It provides detailed insights into response time, team workload, and resolution rates.

Teams can collaborate on emails, assign conversations, and measure performance, all from a shared inbox.

Front also integrates with CRMs and project tools. These integrations help teams reduce back-and-forth and stay accountable on response SLAs and customer communications.

Image via Freshdesk

Freshdesk is another leading help desk solution that excels in email management. It converts support emails into tickets and automates responses. It also helps teams use data to improve email response times by tracking key metrics like first response time and resolution time.

With features like collision detection, canned responses, and SLA policy settings, Freshdesk helps teams respond faster and more effectively. Its analytics module also provides deep insights into agent performance and customer satisfaction.

Also Read:

Improving email response times is crucial for enhancing customer experience and operational efficiency. By leveraging data, businesses can pinpoint delays, track performance, and streamline workflows.

With the right strategies, teams can respond faster and more effectively to customer needs.

Here are some strategies to help you achieve this:

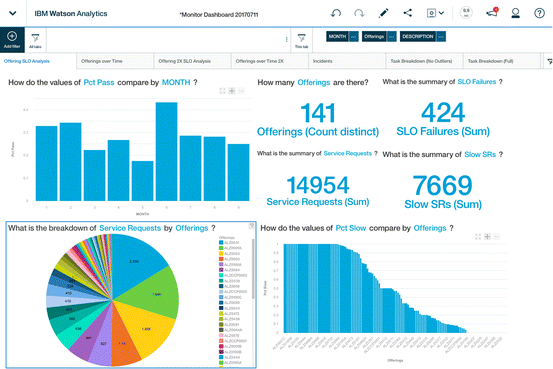

Service Level Agreements (SLAs) set clear expectations for response times, but they must be based on data.

The SLA dashboard shown below helps visualize these goals in action, making it easier to track performance and identify breaches, if any.

Image via Researchgate

Use data to improve email response times by first defining achievable response time goals. These goals should reflect your team’s capacity and the urgency of different issues. This ensures that customer service SLAs are realistic, measurable, and align with customer expectations.

Effective routing of emails can significantly speed up response times. Using data to improve email response times, you can ensure emails are directed to the most qualified agent immediately. This minimizes delays caused by incorrect routing.

By analyzing the types of inquiries each agent handles best, you can route emails more efficiently, further speeding up the process and improving customer satisfaction.

Automated alerts are useful for monitoring email activity and ensuring no messages slip through the cracks. While they don’t directly optimize performance, they’re important for flagging delays early.

By setting up alerts based on response time thresholds, teams can respond to issues in real time and take corrective action before they escalate.

Tracking individual and team performance can help motivate your agents. Use data to improve email response times by creating performance leaderboards that reward fast responses.

Gamifying performance like this fosters healthy competition. This encourages agents to meet response time targets and continuously improve their performance.

Continuous training is key to maintaining high email response standards. By analyzing performance data, you can identify areas where response times are lagging and tailor training to address those gaps.

Whether it’s product knowledge, technical skills, or communication practices, targeted training can make a measurable impact. These programs help team members respond faster and more accurately, directly improving email response times.

By combining training with data-driven strategies, teams can work more efficiently, enhance customer satisfaction, and achieve stronger overall performance.

The result? A case study that speaks for itself.

Companies that empower their customer-facing teams with data significantly improve their email response times and deliver superior customer experiences. Take Hit Promotional Products, a US-based promotional products supplier.

The company chose timetoreply to bring increased visibility to customer emails and provide helpful insights into various elements of its customer-facing operations. Since the vast majority of its customer interactions are over email, Hit Promo wanted to empower its 175-strong customer-facing team with data that could drive improvements in customer experiences and cut down reply times.

As Shannon Sylva, Chief Experience Officer at Hit Promo, says, “One thing is clear: the more we use timetoreply, the better our customer experience will become.”

Let’s talk about doing it the right way.

High-performing teams use data to improve email response times by embedding responsiveness into their culture and operations. Rather than reactively answering emails, they proactively set structures that make fast, high-quality replies the default.

Below are the common traits of these teams and how they use data to improve email response times to maintain their edge:

Top-performing teams have real-time access to service level agreement (SLA) metrics. These metrics aren’t hidden in dashboards only managers can see—they’re visible to every agent, every day.

Data to improve email response times is displayed in team-wide performance boards, reminders, and even embedded in ticketing systems. This ensures that no email is left behind and that agents know when a reply is due before it breaches SLA.

Responsive teams create systems where every agent is accountable for their email performance. There’s clear ownership of who replies to what without confusion caused by shared inbox ambiguity.

Data to improve email response times is reviewed weekly at the agent level, so no one is surprised during performance reviews. It becomes a tool for personal growth, not just management.

High-performing customer service teams implement structured writing and tone guidelines to streamline communication.

Team members use pre-approved templates — often developed using historical email data — to ensure responses are concise, consistent, and easy to understand. This helps reduce unnecessary back-and-forth, minimize escalations, and improve overall email response times.

Every month, top teams review their performance using data to improve email response times. Then, they adjust their targets or processes accordingly.

Whether it’s adjusting shift coverage during peak hours or introducing auto-responses when there’s a backlog, these reviews help teams stay agile. They ensure continuous optimization for faster response and resolution.

Also Read:

But what really to track?

Tracking the right metrics is key to improving email response times and ensuring that your customer support team operates efficiently. By focusing on key performance indicators (KPIs) and using the right tools, you can pinpoint areas for improvement and optimize workflows to boost first call resolution (FCR) rates.

Here are the key metrics to measure email performance:

Also Read:

Improving email response times isn’t a one-time fix. It’s an ongoing effort that requires visibility and alignment across teams.

Below are practical tips to help you keep those improvements going for the long term:

Stay aligned with evolving customer needs by gathering input regularly. This goes beyond just tracking metrics. You can also conduct short internal reviews and debriefing after key customer touchpoints.

Use tools with built-in reporting to spot trends early and adjust workflows before issues grow.

By leveraging these insights, teams can enhance productivity with email analytics and ensure consistent tracking of metrics like first reply time and missed emails.

Managers can analyze performance trends to identify gaps and adjust workflows. From there, they can implement automation to create a data-driven cycle of continuous improvement.

Image via EasyHA

Routine audits help ensure the metrics being tracked are leading to measurable improvements. This includes reviewing how effectively teams are using data to improve email response times and whether response SLAs are being met consistently.

Customer satisfaction surveys provide insight beyond raw numbers. These tools help identify friction points and clarify customer expectations. Additionally, they confirm whether data-driven changes are truly improving the user experience.

Set the tone for performance from the start by integrating email response time data into your onboarding process. Share benchmarks like average response time and first reply time. Explain how these metrics impact both individual performance and team-wide goals.

Use real examples and dashboards to show how high performers use data to improve email response times. This builds a data-driven mindset from day one.

Now that you know all about using data for email response time, here’s what you should steer clear of,

When using data to improve email response times, several common mistakes can undermine your progress. Watch out for:

Also read:

1. How do I measure email response time?

To measure email response time, track the time between when an email is received and when the first reply is sent. Use tools like timetoreply or CRM systems to collect and analyze this data to improve email response times and ensure timely customer interactions.

2. What is a good average email response time for support?

A good average email response time for support typically ranges between one to four hours. Faster response times are associated with higher customer satisfaction.

This is why you must use data to improve email response times and strive for quicker replies to meet customer expectations.

3. How can I improve my team’s email response times using data?

To improve your team’s email response times, analyze historical performance data and identify patterns. Use insights from tools like timetoreply to monitor reply times, measure resolution rates, and make data-driven adjustments that optimize team workflows and communication speed.

4. What tools help track email response time?

Tools like timetoreply, Zendesk, Front, and Freshdesk can help. These tools provide real-time data to improve email response times, offering insights into individual, team, and overall email performance.

5. What are some common email response time metrics to track?

Common email response time metrics to track include average response time, first reply time, response time by agent, and missed replies. Monitoring these metrics helps improve email response times and boosts team efficiency in handling customer inquiries.

Speedy customer service is essential to delivering a positive customer experience. And positive customer experiences lead to increased customer loyalty and retention.

Since email is still the number one channel for customer service, if you want to offer speedy service, you need to improve your email response time.

This is why top customer-facing teams use email performance optimization tools to unlock valuable data to improve email response times. These tools spot trends, uncover bottlenecks, and highlight areas for improvement.

By combining real-time analytics with historical reports, teams get a full picture of their performance so they can improve continuously.

Start leveraging data to improve email response times and drive better service outcomes, make customers happier, and increase retention.

Tools like timetoreply Optimizer are designed to help customer-facing teams transform data into actionable improvements and sustained efficiency.

Get live inbox alerts and reply quickly to customer emails with timetoreply